How to Use the MACD Indicator for Beginner Traders

The Moving Average Convergence Divergence (MACD) indicator, commonly referred to as “mac-dee,” is a widely-used tool among traders. It helps identify the momentum behind price movements of various assets and can signal when a trend is beginning, ending, or continuing.Here’s an in-depth guide on how to interpret MACD charts and use this indicator for technical analysis.

Maximum leverage 1:500

99.35% of orders achieve ultra-fast execution < 13ms

T+0 Speed Withdrawal

Tradable financial products 100+

Understanding the MACD Indicator

To grasp how the MACD indicator works, it's essential first to understand its data sources and significance.

The MACD is typically displayed as a separate graph below the price chart of your chosen market. It aligns with the price chart so that the MACD data corresponds with the price action over the same timeframe.

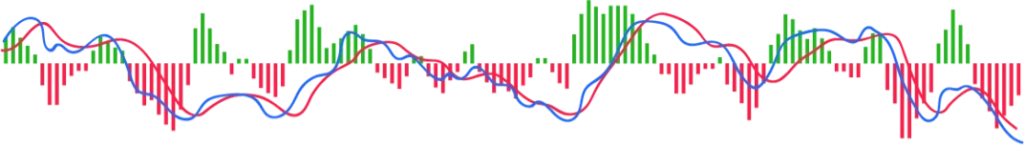

The MACD is calculated using exponential moving averages (EMAs), which are weighted to favor recent data, making them more responsive to current market conditions compared to simple moving averages. The MACD line itself is the difference between the 26-period EMA and the 12-period EMA. Understanding the signal line, which is the 9-period EMA of the MACD line, is also crucial. Traders often watch for when the MACD line crosses the signal line, or they may focus on the distance between these lines. A histogram can also be added to the MACD indicator to visually represent this difference.

Additionally, the position of the MACD and signal lines relative to the zero line in the middle of the graph can provide further insight.

While the default settings for MACD are 26, 12, and 9, platforms like MetaTrader 4 allow traders to adjust these settings for increased or decreased sensitivity.

How to Interpret MACD Charts

One of the MACD's strengths is its ability to generate multiple signals, depending on your strategy:

MACD Crossovers

These occur when the MACD line crosses the signal line, indicating a potential trend change. This can serve as an entry signal for long or short positions. Some traders also use the zero line as a confirmation tool, considering a crossover valid only when it occurs near the zero line.

MACD Histograms

The histogram represents the difference between the MACD and signal lines. When the histogram crosses the zero line, it indicates that the two lines are aligned. The histogram can provide an early indication of an impending crossover.

MACD Divergence

Divergence occurs when the MACD does not match the highs or lows of the price, signaling a potential trend reversal. Divergences can be bullish or bearish, depending on whether the MACD moves opposite to the price trend.

Both MACD and price charts move in waves, making divergence difficult to spot. However, adding trend lines to connect the highs or lows of these waves can help.

Using MACD with Other Indicators

Experienced traders rarely rely on a single indicator. For instance, in forex trading, you might combine MACD with the Relative Strength Index (RSI), candlestick patterns, and Bollinger Bands to confirm market direction and make more informed trading decisions. For example, after spotting a MACD crossover, you might check a candlestick chart for reversal patterns or consult the RSI for additional confirmation.

FREQUENTLY ASKED QUESTIONS

The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator used in technical analysis. It helps traders identify changes in the strength, direction, momentum, and duration of a trend in a stock's price.

The MACD indicator works by calculating the difference between two moving averages of a security’s price:

MACD Line: The difference between the 12-period and 26-period exponential moving averages (EMAs).

Signal Line: A 9-period EMA of the MACD line.

Histogram: The difference between the MACD line and the signal line, represented as a bar chart.

The MACD indicator consists of:

MACD Line: The difference between the short-term EMA (typically 12-period) and the long-term EMA (typically 26-period).

Signal Line: A 9-period EMA of the MACD line.

Histogram: The bar chart that shows the difference between the MACD line and the signal line.

The MACD histogram helps traders visualize the relationship between the MACD line and the signal line:

Positive Histogram: Indicates that the MACD line is above the signal line, suggesting bullish momentum.

Negative Histogram: Indicates that the MACD line is below the signal line, suggesting bearish momentum.

Increasing Histogram Bars: Suggests strengthening momentum in the current direction.

Decreasing Histogram Bars: Indicates weakening momentum or a potential reversal.

Common trading signals include:

MACD Line Crossover: A buy signal occurs when the MACD line crosses above the signal line. A sell signal occurs when the MACD line crosses below the signal line.

Histogram Divergence: When the histogram shows a divergence from the price trend (e.g., higher highs in price but lower highs in the histogram), it may indicate a potential reversal.

MACD Zero Line Crossover: A crossover above the zero line is considered bullish, while a crossover below the zero line is considered bearish.

To use the MACD indicator effectively:

Combine with Other Indicators: Use MACD in conjunction with other technical indicators like moving averages or RSI to confirm signals.

Look for Crossovers: Trade based on crossovers of the MACD line and the signal line.

Watch for Divergence: Monitor for divergences between the MACD histogram and the price to anticipate potential trend reversals.

Consider the Histogram: Analyze the histogram to gauge the strength and direction of the trend.

The limitations of the MACD indicator include:

Lagging Indicator: The MACD is based on historical price data and may lag behind current price movements.

False Signals: MACD can produce false signals during sideways or choppy market conditions.

Not Foolproof: It should not be used in isolation; combining it with other indicators and analysis is recommended for better accuracy.

To set up the MACD indicator on MT4:

1. Open MT4 and select the chart where you want to apply the MACD.

2. Click on the "Insert" menu, then "Indicators," and select "Oscillators."

3. Choose "MACD" from the list.

4. Adjust the parameters (e.g., Fast EMA, Slow EMA, Signal EMA) as needed.

5. Click "OK" to apply the MACD indicator to your chart.

The default settings for the MACD indicator are usually:

Fast EMA: 12-period

Slow EMA: 26-period

Signal Line: 9-period These settings can be adjusted based on your trading preferences and the asset being analyzed.

Yes, the MACD indicator can be used for various asset classes, including stocks, forex, commodities, indices, and cryptocurrencies. It is a versatile tool applicable to different markets and timeframes.

For long-term investing, MACD can be used to identify significant trends and potential entry/exit points:

Long-Term Crossovers: Use MACD crossovers to identify long-term buy or sell signals.

Trend Confirmation: Utilize MACD to confirm long-term trends and avoid potential reversals.

The frequency of reviewing MACD signals depends on your trading style:

Day Traders: Review MACD signals frequently throughout the trading day.

Swing Traders: Check MACD signals on a daily or weekly basis.

Long-Term Investors: Monitor MACD signals on longer timeframes, such as weekly or monthly charts.

Common mistakes include:

Relying on MACD Alone: Avoid using MACD in isolation; combine it with other indicators for better accuracy.

Ignoring Market Conditions: Be aware of market conditions, as MACD may produce false signals in choppy or sideways markets.

Overreacting to Small Movements: Focus on significant MACD crossovers and trends rather than minor fluctuations.

To practice using the MACD indicator:

Use a Demo Account: Trade with a demo account to gain experience without risking real money.

Backtest Strategies: Analyze historical data to test the effectiveness of MACD-based trading strategies.

Review Trade Outcomes: Evaluate your trades and adjust your strategy based on performance and observations.

Additional resources include:

Educational Webinars: Participate in webinars and training sessions on technical analysis and MACD.

Online Tutorials: Explore online tutorials and guides specific to the MACD indicator.

Trading Communities: Engage with trading communities and forums to share insights and learn from experienced traders.