18

2024/10

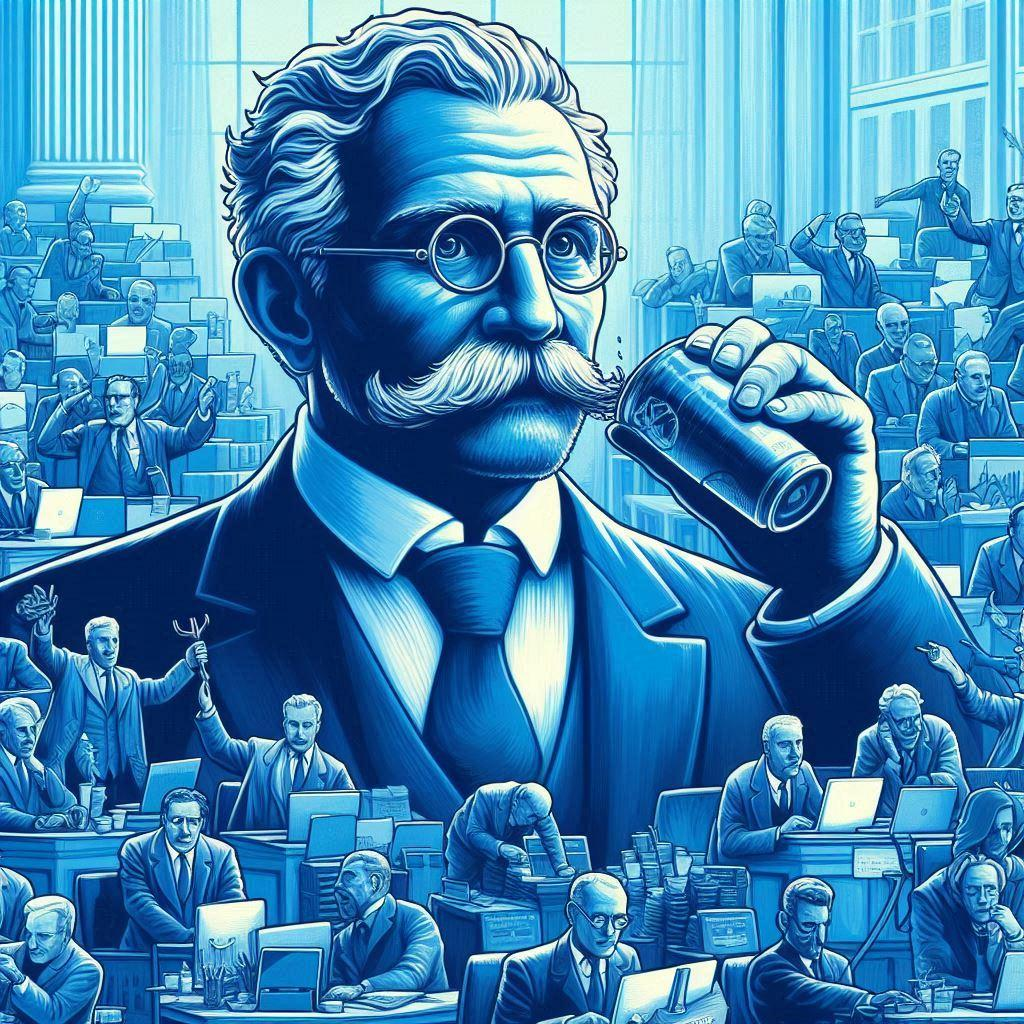

The most famous contrarian investor of the 20th century turned $10,000 into $22 billion !

One of the most renowned contrarian investors of the 20th century, John Templeton, built his wealth from $10,000 to $22 billion! He founded what became the largest and most successful mutual fund group in the world, Templeton Mutual Funds, and was recognized as one of the most successful and prestigious professional investors of the past century. Forbes magazine hailed him as the “pioneer of global investing,” acknowledging his efforts to seek investment opportunities around the globe when others were hesitant.

The New York Times named him one of the “Top 10 Fund Managers of the 20th Century,” and Money magazine called him “the world’s greatest stock picker of the century.” As a philanthropist, Templeton was knighted by the Queen of England in 1987 for his long-standing contributions to charity. “Bull markets are born in pessimism, grow in skepticism, mature in optimism, and die in euphoria.” — John Templeton

Born in Tennessee to a poor family, Templeton excelled academically, earning a scholarship to Yale University, where he graduated with a degree in economics in 1934. He later continued his studies at Oxford University on a Rhodes Scholarship, earning a Master of Laws degree in 1936. Upon returning to the United States, Templeton worked at Fenner & Beane, a predecessor to Merrill Lynch.

1. Contrarian Investing: From $10,000 to $22 Billion

In 1937, during the Great Depression’s lowest point, Templeton founded his company Templeton, Dobbrow & Vance (TDV). By 1939, at the age of 36, he borrowed $10,000 and bought 100 shares in each of 104 different companies. Over the following years, 100 of these companies’ successes brought him his first fortune. His company grew rapidly, managing assets of $100 million with eight mutual funds. When Templeton first established his company, he managed $2 million in assets, and by the time he sold the company in 1967, it had grown to $400 million.

Over the next 25 years, Templeton founded the largest and most successful mutual fund group globally, and he did this without employing salespeople—relying solely on performance to attract customers. In 1992, he sold Templeton Funds again, this time for $440 million to Franklin Group, by which time it was managing $22 billion in assets. In the 1960s and 70s, Templeton was among the first U.S. fund managers to invest in Japan.

He bought Japanese stocks at low prices before other investors realized the opportunity, and after his purchases, the Japanese market skyrocketed. Later, when Templeton saw that the Japanese market was overvalued, he shifted focus to new opportunities—back in the U.S. By 1988, Templeton warned his shareholders that the Japanese market would shrink by 50% or more, and a few years later, the Tokyo Stock Exchange Index dropped by 60%.

Throughout his 70-year career, Templeton created and led one of the most successful mutual fund companies of the time, earning $70 million annually, and his investment approach became legendary. He retired and became an active philanthropist through the John Templeton Foundation, awarding the prestigious Templeton Prize annually to those with outstanding contributions to humanities and science. Templeton passed away on July 8, 2008, in Nassau, Bahamas, at the age of 95 from pneumonia.

2. Investment Method: Investing at “Maximum Pessimism”

As one of the most famous contrarian investors of the last century, Templeton’s strategy was summarized as “buying at the point of maximum pessimism and selling at the point of irrational exuberance.” He sought opportunities in markets and industries that were undervalued but had promising outlooks, often investing in overlooked companies. His “buy low, sell high” approach was most effective when he invested during periods of “maximum pessimism.” Templeton believed that completely neglected stocks were the most attractive bargains, especially those not yet thoroughly analyzed by investors. A classic example was in 1939, during the Great Depression and the uncertainty of war.

He borrowed money to buy 100 shares each of companies listed on the New York and American Stock Exchanges priced under $1. Among the 104 companies, 34 were bankrupt, with four eventually becoming worthless. However, within four years, the value of the entire portfolio grew to $40,000.

3. When to Sell?

A question every investor wants to know is when to sell. Templeton suggested replacing an existing stock only when you’ve found one that is 50% better. In other words, if you hold a stock performing well and trading at $100, and you believe it’s fairly valued, you should only replace it if you find a new stock trading at $25 but worth $37.5. Templeton’s approach stemmed from his goal of buying assets at far below their true value. The key takeaway here is not necessarily the growth potential, but whether the new stock represents an attractive value.

4. The Key is a Company’s Development

If you can find a developing company’s ideal low-price stock, it can provide substantial returns for years. Therefore, focus on the extreme discrepancies between stock price and value rather than minor details. John Templeton was called the “Father of Global Investing” because he introduced Americans to the benefits of investing abroad and pioneered the concept of global investment. Though Sir John Templeton has passed away, his investment methods remain worthy of study.

Achieve Trading Success with WisunoFx

Success in trading is not just about skill and knowledge; it’s also about patience and discipline.

Experience excellence with Wisunofx, your premier destination for online trading solutions! With years of industry experience and a commitment to excellence, we deliver superior value to our clients, combining cutting-edge technology with personalized service to meet their unique trading needs.

Our platform offers a wide range of tradeable instruments, including currencies, commodities, and indices, with ultra-fast execution, competitive pricing, and deep liquidity, ensuring you can seize opportunities in the ever-changing financial markets.

At Wisunofx, we prioritize providing a secure and transparent trading environment with industry-leading encryption technology and strict regulatory compliance measures to safeguard your funds.

Start your journey toward trading success and join the thousands of clients who are already growing their wealth with confidence by opening a live account with WisunoFx today at:

https://tw.wsncrmc.com/register/trader/multi-step

Note: Trading financial products involves high risks and may not be suitable for all investors. Please ensure you fully understand the risks and implement appropriate management measures.